Key Takeaways

- A credit score is determined through a combination of five factors.

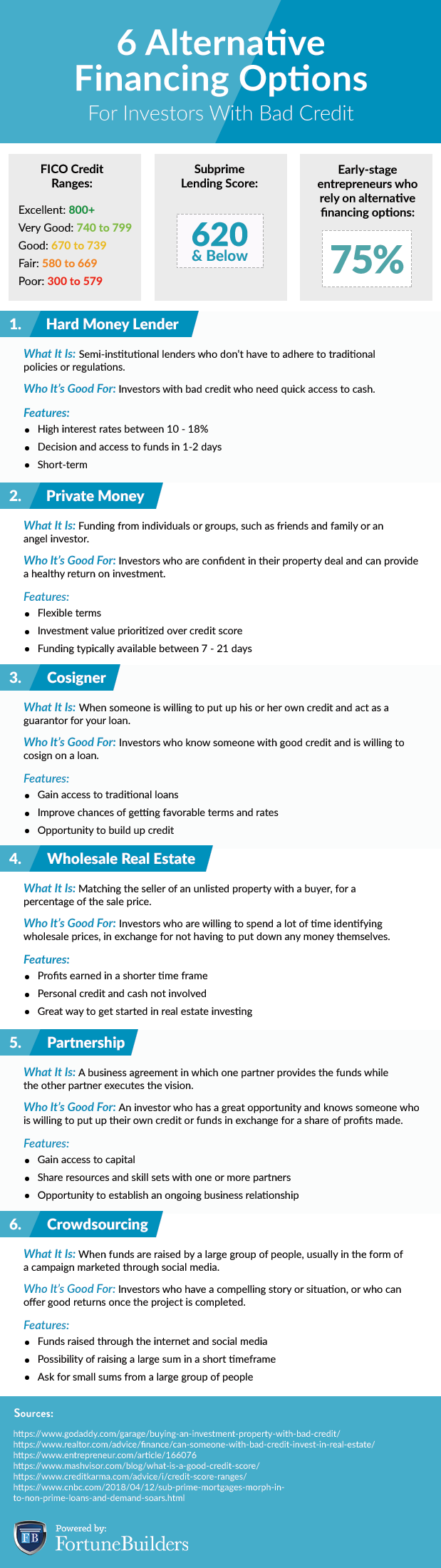

- There are at least six alternative financing options for investors with bad credit to explore.

- The first step to increasing credit score points quickly is to download a free credit report and dispute any errors.

If you have ever tried to apply for a traditional mortgage loan with bad credit, you may have experienced rejection. Unfortunate as this may be, some types of lenders have stringent eligibility requirements for loans, as a method of protecting against the risk of default. One of the most common qualifications is the applicant’s credit score, which demonstrates their ability to responsibly use and pay off credit cards and loans. Below is a guide that discusses how to increase credit score points, as well as some tips just for real estate investors.

How Is Credit Score Determined?

A credit score is determined through a combination of five factors, which are an individual’s payment history, outstanding balances, length of credit history, types of accounts and credit inquiries. The most common credit scoring system is the one determined by FICO, which weighs each of the five factors differently. Starting from most important to least, an individual’s payment history carries 35 percent in terms of impact on a credit score. A payment history gauges how often a person is able to pay off things on time, while they lose points for missed or delinquent payments. Next, outstanding balances indicates how many active credit accounts an individual has, and the proportion of each balance to the credit limit. This factor is attributed to 30 percent of the credit score.

Credit scores tend to increase the longer an individual has credit, which is why some may advise you not to close down old accounts, as long as they are in good standing. Length of credit history is weighted at 15 percent of a credit score. Lastly, both types of accounts and credit inquiries are weighted at 10 percent of credit scores, each. An individual will likely have a better credit score if they have a different range of accounts, such as credit cards, home loans and college loans. At the same time, when opening these different types of accounts, the individual would want to minimize and spread out the number of credit inquiries. Those wondering how to increase credit score points should examine these five factors and which areas need the most improvement.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

What Is A Good Credit Score For Investing In Real Estate?

- Poor: 300 to 579

- Fair: 580 to 669

- Good: 670 to 739

- Very Good: 740 to 799

- Excellent: 800 to 850

According to Credit Karma, the current FICO credit score ranges begin with poor credit, between 300 and 579 points, and can go up to 850 points for those with excellent credit. Although FICO constitutes the most popular credit scoring system, it is good to know that there are several scoring systems, such as the VantageScore, or even industry-specific FICO scores.

Furthermore, every lender has their own set of credit score requirements, which will vary based on the type of loan. For example, those wondering what is a good credit score for real estate investing might find that lenders show preference for applicants with a credit score of 650 or above. However, if you do not have a strong credit score based on the FICO score system, and do not have a strategy on how to improve your credit score fast, do not lose hope. If you feel that you will not be able to qualify for a traditional loan, there are still plenty of alternative options out there.

Alternative Financing Options For Investors With Bad Credit

- Hard money lender: Hard money lenders are semi-institutional lenders who are not required to adhere to policies and regulations that are required of banks. Because of this, they are able to offer faster access to financing to lenders with less stringent eligibility requirements. However, investors should be prepared to pay a much higher interest rate over a short loan period.

- Private money: Some investors are able to tap into their personal networks, such as friends and family, to obtain a loan. This can be helpful for investors trying to get their start in real estate, or while they work on improving their credit scores. Personal acquaintances tend to operate on a sense of trust, and can set their own terms.

- Cosigner: Instead of a loan, investors can sometimes find a friend or family member who is willing to put up their own credit by acting as a cosigner on a loan. This option helps investors get access to more traditional financing options.

- Wholesale real estate: Another great option for investors with bad credit is getting into wholesale real estate, which seldom requires personal funds or credit. In wholesaling, investors act as a middle man by connecting the sellers of unlisted properties to end buyers. A great way to break into real estate investing with little to no capital, those who choose this route should be prepared to spend a lot of time identifying wholesale properties.

- Partnership: A partnership is a business agreement between two or more real estate investors to execute a real estate deal. It is possible to make an arrangement through which just one of the partners provides the financing, while the other executes the deal or puts in any grunt work. In a partnership, all partners typically follow a profit-sharing model.

- Crowdsourcing: With the rise of social media, crowdsourcing has become a popular way for individuals to raise funds from a large group of people by launching a fundraising campaign. Crowdsourcing is not limited to real estate, and can raise to any type of cause.

Why Should I Improve My Credit Score?

Investors should improve their credit score due to the myriad of benefits it can provide for a career in real estate. First off, having a strong credit score demonstrates to lenders that you are qualified, which can help speed up approval processes. There is nothing more unfortunate, nor frustrating, than missing out on a great real estate deal simply because financing could not be obtained in time. In addition, having good credit history will help you gain access to an increased number of different financing options, as well as lower interest rates. This alone should provide a strong incentive to learn how to increase credit score points quickly; lower interest rates, as well as access to better financing options, will save investors a significant amount of money in the long run. Finally, having strong credit will also give you the grounds to negotiate with your lender, potentially leading to more favorable terms. Hopefully, these reasons provided strong arguments for why an investor should improve their credit score. The next section will discuss some strategies on increasing your credit score fast.

How To Increase Your Credit Score Fast

You may now be wondering how to increase credit score points as quickly as possible, now that the many benefits of having a high credit score have been discussed. Having a healthy financial profile is paramount, not just in real estate investing, but in various aspects of life. Below are some tips and tricks on how to increase your credit score fast:

- Download a free credit report and dispute any errors.

- Pay down credit balances to below 30 percent of the credit limit.

- Ask creditors for goodwill adjustments on late payments.

- Ask debt collectors to state in writing that they will remove collection accounts if paid.

- Call credit card companies and ask if they will raise your credit limits.

- Make sure open accounts are not underutilized by charging and paying off small amounts.

- If you only have one credit card, open another account.

- Stop using your credit cards to pay for each and every purchase.

- Consolidate credit card debt into one high-balance, low-interest account.

If you desire a successful and illustrious career in real estate investing, then prioritizing good financial hygiene should be made a priority. Even for those who prefer to rely on alternative financing options may risk running out of funding options down the line. Learn about how to increase credit score points and devise a strategy today.

Do you have any additional thoughts on the importance of having a good credit score? Feel free to share below: