Jump To Another Year In The Jacksonville Real Estate Market:

The Jacksonville real estate market in Florida looks poised to benefit from the momentum it generated last year. That’s not to say real estate in Jacksonville hasn’t experienced a setback in the wake of COVID-19, but rather that it appears to have fared slightly better than many of its national counterparts. The local housing market has maintained healthy home values and kept demand intact, all while preserving future prospects. Perhaps even more importantly, the economy seems to have fared better than most other cities after the introduction of the Coronavirus. Local unemployment levels didn’t spike as high as national averages, which bodes well for a quicker return to normalcy. While the pandemic has served as an obstacle, the largest city in Florida looks positioned to return to pre-pandemic levels sooner than later, which bodes well for everyone participating in the market: buyers, sellers, and investors.

Jacksonville Real Estate Market 2021 Overview

-

Median Home Value: $218,194

-

1-Year Appreciation Rate: +11.2%

-

Median Home Value (1-Year Forecast): N/A

-

Median Rent Price: $1,345

-

Price-To-Rent Ratio: 13.51

-

Unemployment Rate: 3.7% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 911,507 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $54,701 (latest estimate by the U.S. Census Bureau)

-

Percentage Of Vacant Homes: 13.86%

-

Foreclosure Rate: 1 in every 3,935 (2.5%)

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

2021 Jacksonville Real Estate Investing

Heading into 2020, the prospects of real estate investing remained attractive across the country. Real estate investors were the beneficiaries of a healthy marketplace, and those in Jacksonville were no exception.

“Homes flipped in the first quarter of 2020 were sold for a median price of $232,000, with a gross flipping profit of $62,300 above the median purchase price of $169,700. That gross-profit figure was up from $62,000 in the fourth quarter of 2019 and from $60,675 in the first quarter of last year,” according to Attom Data Solutions.

Investors have coveted real estate in Jacksonville for the better part of a decade. However, it is worth noting that years of appreciation have started to take a toll on profit margins. Real estate has seen its profit margins grow slimmer due to historically high appreciation rates.

The decline in year-over-year profit margins isn’t an indictment on the state of real estate investing, but rather a sign that the investing landscape has shifted. In addition to years of historical appreciation and the new market onset by the Coronavirus, indicators seem to lean heavily in favor of long-term investors. Rental property owners, in particular, appear to receive an edge in the Jacksonville real estate market because of the new housing landscape. In fact, there are three things currently working on behalf of passive income investors in today’s marketplace, and they are all the result of what has happened over the course of the last year:

-

Interest rates on traditional loans are historically low

-

Years of cash flow can easily justify today’s higher acquisition costs

-

The price-to-rent ratio suggests high home prices will increase rental demand

As of March, the average rate on a 30-year fixed-rate loan was 3.08%, according to Freddie Mac. While higher than in recent months, the latest interest rate is still considered attractively low. As a result, lower borrowing costs have brought down acquisition costs for those looking to add to their passive income portfolios. At their current rate, mortgage rates will save today’s buyers thousands of dollars, and real estate investors will be able to pad their bottom line. Additionally, lower mortgage obligations will allow investors to increase their cash flow from properties put in operation.

Last but certainly not least, is the city’s 13.51 price-to-rent ratio which leans in favor of landlords. With home values as high as they are and annual rent rates averaging more than $16,000, it is actually more affordable to buy a home than to rent one. Typically, a 13.51 price-to-rent ratio would hurt the prospects of rental property owners because demand favors sellers. However, the presence of the Coronavirus has drastically reduced inventory levels. Even those looking to buy are forced to rent, despite having the cash to make a purchase. As a result, demand for rental is up, which bodes well for the entire real estate investing community.

Investors are lucky to have several viable exit strategies at their disposal. Still, none appear more attractive than building a proper rental property portfolio in the wake of a pandemic. Too many important market indicators are pointing towards becoming a buy-and-hold investor to ignore.

2021 Foreclosure Statistics In Jacksonville

Jacksonville’s foreclosure rate is higher than the national average. Not only is the foreclosure rate in Jacksonville higher than the national average, but it is more than three times the country’s foreclosure rate. To put things into perspective, one in every 11,396 homes across the United States is distressed, which translates to a foreclosure rate of 0.8%.

All things considered, the Jacksonville real estate investing community may be able to help homeowners on the brink of foreclosure and perhaps even flatten the distressed inventory curve. At the very least, all-cash purchases on behalf of investors could prevent financially strapped homeowners from falling into bankruptcy, which begs the question: Is Jacksonville a good real estate investment? To be clear, it is possible to invest in any market, and Jacksonville is no exception. With the proper understanding of the current market and a sound real estate education, investing in real estate can be a great move in 2021.

Opportunities abound across the entire city for those who know where to look, but one question seems to be coming to the top of investors’ minds first: Where can I invest in Jacksonville, FL?

Investors looking to rehab deals should consider looking at the city’s foreclosure inventory. Most of the city’s distressed inventory resides in the auction market. More specifically, 57.0% of the city’s foreclosures are either up for auction or will be at some point soon. That means local investors will increase their odds of finding a deal with attractive profit margins if they attend local auctions.

The neighborhoods with the highest distributions of foreclosures in Jacksonville are:

-

32234: 1 in every 884 homes is currently distressed

-

32219: 1 in every 1,174 homes is currently distressed

-

32254: 1 in every 1,174 homes is currently distressed

-

32220: 1 in every 1,364 homes is currently distressed

-

32209: 1 in every 1,893 homes is currently distressed

The Coronavirus is expected to take a significant financial toll on homeowners and perhaps even cause an influx in foreclosures in the coming months. While it is too soon to tell just how much foreclosures will increase, investors who line up financing and position themselves for success at this time could be in line for a busy second half of 2021.

2021 Median Home Prices In Jacksonville

At $218,194, the median home price in Jacksonville is well below the national average. That said, local home values have had a historic run for the better part of a decade. Looking at today’s median home value doesn’t paint the whole picture. To get an idea of how far the market has come, we’ll need to look back to the first quarter of 2012 (when the city showed its first signs of recovery). At that time, the median home value was around $108,000. That means the median home value has increased more than 102.0% in a little over nine years.

To put things into perspective, the median home value in the United States was about $161,000 in the first quarter of 2012. Today, the median home value across the country is $272,446, which represents a 69.2% increase.

While the median home value may not be as high as the national average, it has had a better run over the last nine years. In the last year (February 2020 to February 2021) specifically, home values have appreciated faster than the national average—11.2% and 9.9%, respectively.

The increase may be attributed to many factors, but three indicators stand out: an improving national economy, positive sentiment, and (ironically) a distinct lack of available inventory. In association with the end of the Great Recession, these three indicators helped boost the real estate market out of one of the worst recessions in American history and into nearly a decade’s worth of positive growth.

Years of historic appreciation have made these the most expensive neighborhoods in Jacksonville (according to NeighborhoodScout):

-

Ortega / Ortega Forest

-

Greenfield

-

Greenland

-

Saint Johns Ave / King St

-

Avondale

-

Hendricks Ave / San Jose Blvd

-

San Jose Forest

-

Ortega Terrace

-

Deerwood Club

-

Isle of Palms

Unemployment in Jacksonville appears to have fared slightly better than the national average. What’s more, the inventory shortages that have contributed to a price increase over the last nine years have not been resolved. In fact, builders have been forced to stop working in many states, effectively pushing back the timetable to expect inventory levels to rise. As a result, pent-up demand should create competition and drive up prices.

Jacksonville Real Estate Market: 2020 Summary

-

Median Home Value: $195,692

-

1-Year Appreciation Rate: +6.2%

-

Median Home Value (1-Year Forecast): -0.2%

-

Median Rent Price: $1,345

-

Price-To-Rent Ratio: 12.12

-

Unemployment Rate: 11.2% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 911,507 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $52,576 (latest estimate by the U.S. Census Bureau)

-

Percentage Of Vacant Homes: 13.86%

-

Foreclosure Rate: 1 in every 11,841 (0.8%)

Jacksonville Real Estate Investing 2020

Jacksonville real estate market trends were shaped largely by the pandemic in 2020. Much like everywhere else, real estate in Jacksonville was looking to carry over trends from 2019 into 2020. However, the introduction of the pandemic quickly put a stop to any emerging trends in the first quarter. In a matter of weeks, fear and uncertainty onset by COVID-19 brought the local housing sector to a standstill. Market participants were simultaneously scared to show homes, tour homes, and even meet to underwrite loans. Simply put, the pandemic created a significant bottleneck in the housing sector by the end of the first quarter.

For a moment, it looked as if the pandemic would spell the end of nine consecutive years of appreciation. Instead, the pandemic actually catalyzed even more activity than anyone could have imagined. When the Fed lowered interest rates well below three percent, buyers couldn’t help but take action. Borrowing costs were attractive enough to offset fears of the pandemic, and buyers came out in droves; so much so, in fact, that demand greatly outweighed supply. The resulting competition over the little housing available lead to significant increases in home values. From the end of the first quarter through the rest of 2020, the city’s median home value increased 7.6%; that’s in addition to the previous eight consecutive years of appreciation.

Prices increased at a nearly exponential rate, and the Jacksonville real estate investing community was forced to reevaluate its preferred strategies in 2020. Higher home prices meant profit margins were smaller and growing slimmer. Homes were too expensive to flip without an inherent level of risk. As a result, local investors turned to their rental portfolios. Investors took advantage of lower borrowing costs and supporting market fundamentals to exercise long-term strategies. With rates as low as they were, investors could simultaneously offset higher acquisition costs and increase monthly cash flow from homes in operation. Simply put, the Jacksonville real estate market favored long-term strategies over short-term flips for the better part of 2020.

Jacksonville Real Estate Market: 2018 Summary

-

Median Home Value: $166,500

-

1-Year Appreciation Rate: 10.3%

-

Median Home Value (1-Year Forecast): 5.6%

-

Median Rent Price: $1,250

-

Number Of Foreclosures: 3,611

-

Homes For Sale: 2,262

-

Recently Sold: 9,505

-

Median Days On Market: 63

Jacksonville Real Estate Investing 2018

The Jacksonville real estate market was a hotbed of activity for real estate investors from 2012 to 2018, partly because of its relative affordability. To that end, local real estate comes with a less expensive price tag than the national average, so it only makes sense that real estate investors would gravitate to the Florida city. However, it is worth noting that the Florida city wasn’t able to evade the same inventory crisis facing the rest of the country. While prices were relatively low compared to just about anywhere else, they were heading up, according to Jacksonville real estate news outlets at the time.

The appetite for real estate investing placed the city amongst the top five zip codes with an average time to flip a home under 100 days. In other words, turnaround times on flips were faster than most of the country at the time. The average time to flip a home in Jacksonville took 99 days.

Jacksonville Real Estate Market: 2016 Summary

-

Current Median Home Price: $215,000

-

1-Year Appreciation Rate: 7.5%

-

3-Year Appreciation Rate: 20.2%

-

Unemployment Rate: 4.7%

-

1-Year Job Growth Rate: 3.7%

-

Population: 842,583

-

Median Household Income: $48,143

Jacksonville Real Estate Investing 2016

The sun shone brightly on the Jacksonville real estate market in 2016. The second quarter brought a series of highs for the Bold New City of the South, with home prices, appreciation rates, and job growth all showing improvements. Unemployment and home affordability also continued to look good. The market continued to sway in investors’ favor, as gains in home prices over the previous three years extended the trend of positive price growth after the recession. The Jacksonville housing market was also one of the more affordable in the nation, which aided investors and homeowners, including growing demand for rental properties.

The local real estate market was running on all cylinders in the second quarter of 2016. While price growth slowed, home prices were up from the previous year, with appreciation rates climbing past the national average. In fact, the previous seven years witnessed total equity gains quietly surpass the rest of the country.

The local economy was the strength of the city at the time. Employment held up and was on an upward trend, as one-year job growth rose to 3.7% during the second quarter, compared to the national average of 1.9%.

Jacksonville Real Estate Market: 2015 Summary

-

Median Home Price: 186,500

-

1-Year Appreciation Rate: 0.8%

-

Unemployment Rate: 5.8%

-

1-Year Job Growth Rate: 3.3%

-

Population: 842,583

-

Median Household Income: $48,143

Jacksonville Real Estate Investing 2015

Jacksonville is the largest city in Florida, both in terms of population and sheer size. Therefore, positive trends in the real estate industry should be viewed as a big step for the entire state of Florida. Fortunately, the local market has made significant improvements since 2015. Experts expected both a strengthening job sector and increasing home values to continue. For all it went through since the recession, Jacksonville was doing very well for itself as early as 2015.

While not as highly publicized as some of Florida’s more prominent markets, the Jacksonville housing market was making a name for itself at the time. Despite being in a distressed state, trends suggested that the local market did enough to remove itself from a period of post-recession price weakness. The average price of a home was $186,500. Despite historically high appreciation rates over the previous three years, the median home price was about $30,000 below the national average. On a more encouraging note, experts predicted an increase of more than 2.0% in home prices.

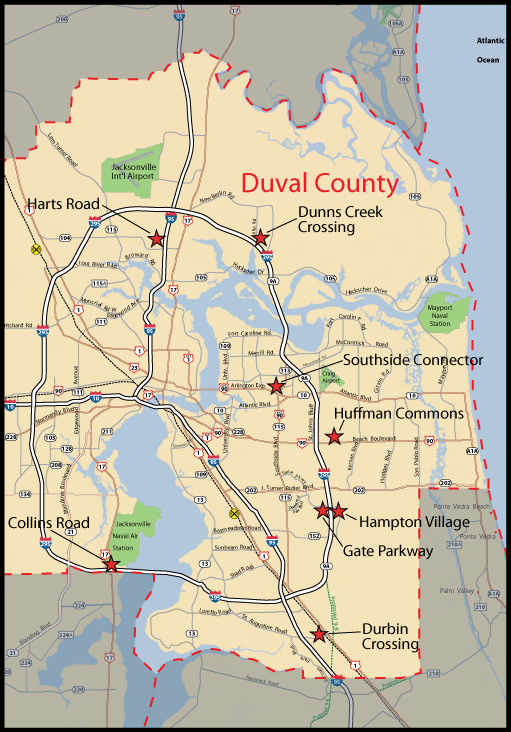

Jacksonville County Map:

Jacksonville Real Estate Market Summary

The Jacksonville real estate market has done a lot to remove itself from the period of post-recession price weakness that followed the last recession. For what it’s worth, real estate in Jacksonville was hit hard, much like the entire state of Florida. However, Jacksonville had made up a lot of ground and now stands to come out on the other end of 2020 even stronger than when it went in. The unique combination of affordability, relative economic stability, and pent-up demand should usher in an active real estate market sooner rather than later. As a result, buyers, sellers, and investors should all benefit in their own ways.

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!