The Kansas City housing market, situated precariously on the border of Kansas and Missouri, has developed a reputation for affordable real estate, strong cash flow, and great investment opportunities. Perhaps even more importantly, however, is the city’s position to cater to first-time homebuyers. Thanks—in large part—to a relatively low median home value, real estate in Kansas City has seen a large increase in demand for entry-level homes. While that’s not necessarily unique to the “Gateway of the Southwest,” it is important to note that few cities (if any) have seen a larger increase in FHA buyers in recent history.

First-time buyers are inherently drawn to the Kansas City housing market, but demand may increase on the heels of several prominent indicators. The Coronavirus, in particular, has forced the government’s hand into reducing interest rates to a level that new buyers will find irresistible. On top of that, local unemployment appears to have been slightly more insulted than the national average, which should serve as a catalyst moving forward. Thus, while COVID-19 was undoubtedly unwelcome, it may have actually disrupted the Kansas City real estate market enough to create an opportunity for everyone: buyers, sellers, and investors.

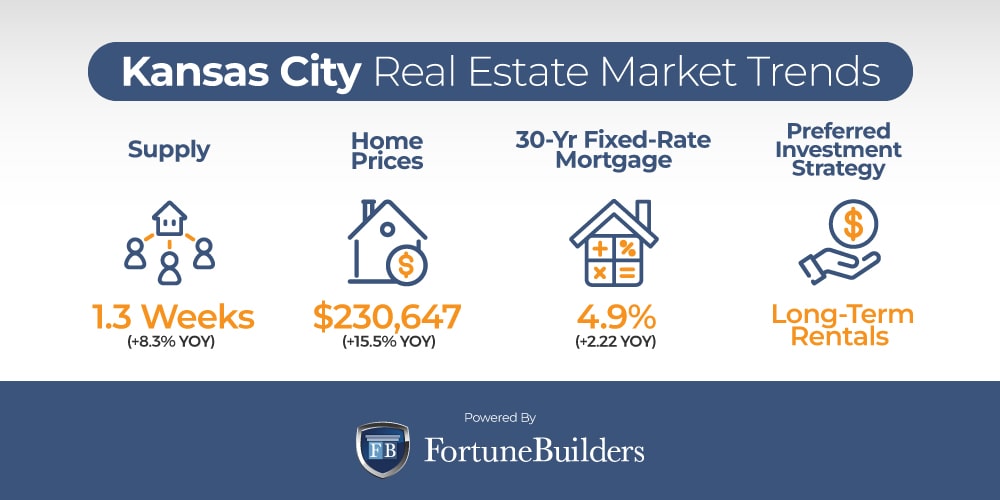

Kansas City Real Estate Market 2022 Overview

-

Median Home Value: $230,647

-

Median List Price: $419,667 (+9.2% year over year)

-

1-Year Appreciation Rate: +15.5%

-

Median Home Value (1-Year Forecast): +7.6%

-

Months Of Supply: 1.3 (+8.3% year over year)

-

Total Inventory: 4,733 (+1.5% year over year)

-

Median Days On Market: 16 (-11.1% year over year)

-

Closed Sales: 4,331 (-9.8% year over year)

-

Pending Sales: 4,078 (-3.7% year over year)

-

Median Rent: $1,203 (+8.6% year over year)

-

Price-To-Rent Ratio: 15.97

-

Unemployment Rate: 2.6% (latest estimate by the Bureau Of Labor Statistics)

-

Population: 508,394 (latest estimate by the U.S. Census Bureau)

-

Median Household Income: $56,179 (latest estimate by the U.S. Census Bureau)

-

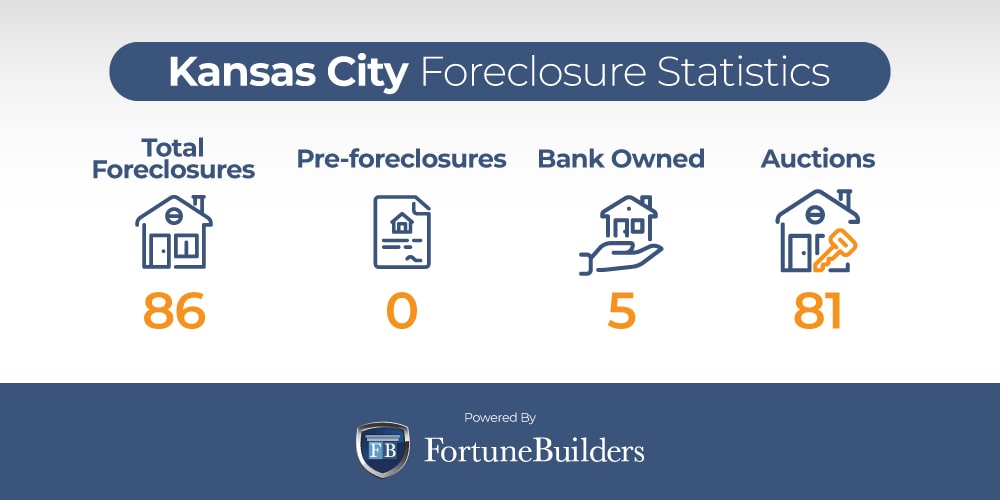

Total Active Foreclosures: 86

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Kansas City Real Estate Market Trends 2022

“The City of Fountains” has experienced a lot in the wake of the pandemic, which has many residents asking one simple question: Is Kansas City a good place to invest in real estate? As long as investors listen to prominent market trends, the answer is a resounding yes. That said, let’s take a look at the Kansas City real estate market trends most likely to play out in the near future. Now that interest rates are rising and the economy is suggesting a slowdown may be imminent, the most recent Kansas City housing market trends have started to emerge:

-

Supply Trends: The latest Kansas City housing market trends suggest there are a total of 4,733 listings. On average, inventory last about 16 days on the market. At the rate of homes being sold, Kansas City has about 1.3 months of inventory. Listings are up slightly year over year, and should continue higher. With interest rates increasing, fewer buyers are in the market and few owners want to sell because their mortgage rates will increase. All things considered, activity is cooling and adding more inventory to a market that needs it desperately. KC homes for sale will level out as the economy starts to normalize.

-

Home Price Trends: The average Kansas City house value has increased for the better part of 10 years. Over the last two years, however, the pandemic has seen prices rise at a historic pace. Low interest rates, pent-up demand, and a lack of inventory turned demand into competition. Over the last year the median home price in Kansas City has increased 15.5%. Despite the increase, prices will continue rising. The same indicators responsible for price hikes in the past are still present. Prices may increase as much as 7.6% over the next 12 months; a slower pace than in previous years, but fast nonetheless.

-

Interest Rate Trends: In an attempt to combat the highest rate of inflation the Fed has seen in nearly 40 years, interest rates have risen. In order to cool off the housing market, the Fed has planned a series of rates hikes, not the least of which has brought the average commitment rate on a 30-year fixed-rate mortgage to 4.99%, an increase of 2.22 points year over year. While up year to date, it is safe to assume rates will climb even higher, making the Kansas City housing market less affordable over the course of 2022.

-

Investor Trends: Attractive profit margins on investment properties are growing harder to find. Homes simply cost too much for most to represent viable flipping opportunities. As a result, the Kansas City real estate investing community has turned to long-term rental properties. While acquisition costs will remain high, borrowing costs are still attractive and investors can capitalize on higher rents to justify their purchases. More importantly, however, the added demand will decrease the three of vacancies.

Foreclosure Statistics In Kansas City 2022

Foreclosures were on the decline for the better part of 2021. Government intervention and foreclosure moratoriums prevented many lenders and banks from starting the foreclosure process on distressed homeowners. The moves served as a safety net for homeowners and were intended to prevent another housing crisis, like the one we saw in 2008. However, it is worth noting that foreclosures started to creep up towards the end of the year, when assistance began to expire.

According to ATTOM Data Solutions’ last Foreclosure Market Report, “there were a total of 164,581 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2022. That figure is up 153 percent from the same time period a year ago but down just one percent from the same time period two years ago.”

“Foreclosure activity across the United States continued its slow, steady climb back to pre-pandemic levels in the first half of 2022,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “While overall foreclosure activity is still running significantly below historic averages, the dramatic increase in foreclosure starts suggests that we may be back to normal levels by sometime in early 2023.”

Not unlike most of its other metropolitan counterparts, the Kansas City real estate market will most likely see an increase in foreclosure filings. With 86 foreclosures identified by RealtyTrac, more are sure to follow. As more distressed homeowners are asked to come current, filings will almost certainly increase. While it’s too soon to tell just how many foreclosures will be filed in Kansas City, it is safe to say there will be more than last year. Investors intent on buying a foreclosed property in the Kansas City housing market should attend local auctions. The overwhelming majority of the city’s foreclosures are expected to be sold at auction.

Kansas City Median Home Prices In 2022

In the last year, real estate in Kansas City has appreciated as much as 15.5%. At that rate, the Kansas City real estate market slightly trailed the national average. Nonetheless, the median home value in the Kansas City real estate market now sits at $230,647.

For some perspective, real estate in Kansas City has appreciated each year since 2012. In that time, home prices have increased (on average) upwards of 126.1%. The median home value in the United States, on the other hand, increased 112.0% over the same period of time. The reason for the higher rate of appreciation may be attributed to Kansas City’s employment rate. With a better-than-average unemployment rate, more people have made the move to homeownership over the last decade.

Higher rates of employment, combined with the city’s low inventory level, have driven prices up almost exponentially. Competition has enabled homeowners to increase prices accordingly, which begs the question: Is it a good time to buy a house in Kansas City? The answer will depend on the timing of the purchase. Those looking to buy sooner rather than later will find today to be a great time to buy a house in Kansas City. If for nothing else, interest rates are still relatively low, and the inventory crunch is likely to drive prices higher for the foreseeable future. Experts expect homes to appreciate an additional 7.6% in the coming year, and there’s nothing to suggest they are wrong. As long as inventory levels remain as low as they currently are and demand remains healthy, prices will rise.

Still, today’s rate of appreciation is unsustainable, and prospective buyers are already being priced out of the market. Once new builds are brought to the market, real estate in Kansas City will correct itself. The shift is likely years away, but those afforded the time may find better prices in the next cycle.

Should You Invest In The Kansas City Housing Market?

The Kansas City real estate investing community is currently the beneficiary of some rather favorable indicators. More specifically, market conditions may very well favor investors on both the buying and selling end of transactions. For starters, real estate in Kansas City remains incredibly affordable. While prices have risen at a historic pace over the last year, median home values are still well below the national average, which would suggest investors who can’t afford to operate in more expensive markets may be able to secure a deal in Kansas City.

The same affordability working in favor of Kansas City real estate investors has also helped traditional buyers. The local market recently saw the fifth-largest increase in FHA buyers across the country (many of whom are first-time buyers or can’t afford to put down 20.0% upfront). In fact, 17.6% of all sales were made to buyers with an FHA loan heading into last year. Therefore, investors may simultaneously purchase relatively affordable homes in a market where an increasing number of people are looking for their first houses. The unique combination of affordability and demand should work heavily in favor of the entire Kansas City real estate investing community.

It is worth noting that the introduction of the Coronavirus has shifted the city’s most viable exit strategy from rehabbing to long-term rental properties. First and foremost, nearly a decade’s worth of appreciation has increased home prices to historic levels. As a result, profit margins on flips are growing slimmer. That’s not to say rehabbing isn’t still a great idea in Kansas City, but rather that today’s indicators seem to favor rental properties.

In addition to historical rates of appreciation, it’s still affordable to borrow institutional money. The Fed announced it would increase rates, and they haven’t let buyers down. According to Freddie Mac, the average monthly commitment rate on a 30-year fixed-rate mortgage is 5.99%. Rates are up year to date, but it is important to put them in context; they are sill relatively affordable.

Low interest rates will simultaneously help investors justify today’s higher home prices and reduce their monthly mortgage obligations. In doing so, the prospects of renting a property to tenants become a lot more attractive. Lower monthly mortgage payments are easier to offset with rental cash flow, and investors may find it easier to pay down their mortgages with other people’s money in the Kansas City housing market.

Another factor contributing to the attractiveness of building a rental property portfolio in Kansas City is supply and demand. To be clear, there aren’t enough homes in Kansas City to keep up with demand. With the end of the year growing closer, Kansas City only has about 1.3 months of supply. Traditionally, a healthy market has about six months of inventory, which leaves real estate in Kansas City well short. As a result, more people will be forced to continue renting, whether they can afford to buy or not. The demand for rental properties will not only help avoid vacancies, but it may even increase cash flow for investors.

The unique combination of indicators created in the wake of the pandemic has made rental properties in Kansas City more attractive than ever. Today, investors who can put money to work now may be happy they did, even just a few years from now.

[ Learning how to invest in real estate doesn’t have to be hard! Our online real estate investing class has everything you need to shorten the learning curve and start investing in real estate in your area. ]

Top Reasons To Invest In Kansas City Real Estate

The Kansas City real estate market offers just as many reasons to invest in real estate as today’s best markets. In addition to boasting national benefits like attractive interest rates and plenty of demand, the Kansas City housing market also offers the following:

-

Low Unemployment

-

Fast Growth

-

High Quality Of Life

-

Low Cost Of Living

-

Attractive Renters’ Markets

Low Unemployment Rate In Kansas City

Not surprisingly, the pandemic caused a surge in unemployment over the last two years. Once COVID-19 was declared a global emergency, the unemployment rate in the United States jumped from 4.4% in March 2020 to 14.7% in as little as a month. At the same time Kansas City’s unemployment rate jumped from 4.0% to 13.2%. The increases were understandably similar, but Kansas City has fared much better than the national average since the initial spike. Today, Kansas City’s unemployment rate is somewhere in the neighborhood of 2.6%, below pre-pandemic levels. The high percentage of employed individuals has served as a catalyst for the housing sector, and should continue doing so moving forward.

Fast Growth In Kansas City Is Expected

The pandemic has altered the general publics’ view on homeownership. In particular, work-from-home trends are allowing more and more people to trade expensive living situations for more affordable alternatives. Primary cities across the country are experiencing net losses in migration as residents pack up and leave for places like Kansas City. With a median home value that’s about $109,091 less than the national average and plenty of employment opportunities, Kansas City is becoming the beneficiary of positive net migration.

High Quality Of Life In Kansas City

In addition to providing more affordable housing than most of the country’s primary cities, Kansas City also has a high quality of life. According to U.S. News, Kansas City is ranked number 57 on the “Best Places To Live” in the country list. The placement on the list is largely due to the better-than-average job market and affordable housing. Still, Kansas City is a vibrant community with plenty to offer anyone that chooses to call it home.

Low Cost Of Living In Kansas City

The unique convergence of affordable housing, employment opportunities, and income standards has made the Kansas City housing market relatively affordable when compared to most of its peers. According to U.S. News, “Kansas City offers a better value than similarly sized metro areas when you compare housing costs to median household income.” Looking forward, local home prices aren’t expected to appreciate as much as the median home value in the United States, which bodes well for local homeowners and their bank accounts.

Attractive Renters’ Market

Rental markets are growing more and more attractive across the United States. As more people are priced out of the housing market or simply can’t compete with all of the competition, the demand for rental units will increase. Rental demand is increasing everywhere, and the Kansas City housing market is no exception. Asking rental rates have already increased 9.6% year over year, and the next 12 months will look to continue the momentum. In fact, rates are expected to increase more than their home price counterparts, as more people are forced to rent.

Summary

The Kansas City real estate market has enjoyed a good run for the better part of a decade. Moving forward, appreciation rates are expected to run up for at least a year, which may spark near-term activity. As a result, the demand from new buyers should remain intact and help the city weather the current storm. More importantly, however, is the disruption onset by the Coronavirus. While the pandemic was unwelcome, it may have actually generated a great opportunity for everyone in the market.

Have you considered investing in the Kansas City real estate market? If so, what are you waiting for? We would love to know your thoughts on real estate in Kansas City in the comments below:

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

Sources

https://www.zillow.com/kansas-city-mo/home-values/

https://www.zillow.com/home-values/

https://www.zillow.com/research/data/

http://www.freddiemac.com/pmms/

https://realestate.usnews.com/places/missouri/kansas-city

https://www.apartmentlist.com/research/category/data-rent-estimates

https://www.redfin.com/news/data-center/

https://kcrar.stats.showingtime.com/docs/lmu/x/HeartlandMLS?src=map

https://www.bls.gov/eag/eag.mo_kansascity_msa.htm

https://www.census.gov/quickfacts/kansascitycitymissouri

https://www.realtytrac.com/homes/mo/clay/kansas-city/

https://www.attomdata.com/news/market-trends/foreclosures/attom-midyear-2022-u-s-foreclosure-market-report/