The commercial real estate market, not unlike the single-family housing and residential markets, is subject to cyclical trends. Investors are constantly looking for how these trends might affect their individual markets for the foreseeable future and ask themselves: what are the best real estate markets for commercial investments? These ever-changing trends and their impact are what drives an investor’s strategy on how they will edge out their competition. To better understand the current and upcoming commercial real estate market trends, it’s also important to review the trends that brought us to today.

Understanding Today’s Commercial Real Estate Market

The real estate market has proven to be a reliable and successful wealth-building tool for investors in recent years and is expected to continue its growth in 2022.

At the beginning and peak of the COVID-19 crisis, experts and professionals alike were concerned about the short and long-term effects on the real estate market. The pandemic undeniably impacted the economy on many levels. However, the real estate market continued to move without slowing down.

The pandemic did force commercial space occupants to adapt quickly, but COVID-19 statistics are improving and businesses are resuming to operate normally. Many businesses had to take new health policies into account before requiring in-office work. Some businesses continue to adapt and implement work from home or partial work from home policies successfully. Demand for office space have risen again as businesses who prefer to work face to face have been cleared to do so.

Commercial real estate agents can also expect demand for a restructured design of office spaces. Some commercial landlords may find that changing their buildings to accommodate more space or privacy between employees will prove an attractive quality to prospective tenants.

Although the changes that the COVID-19 pandemic has caused have been challenging for the commercial real estate industry, the quick return to commercial spaces has proven encouraging. As the economy recovers and workplaces adapt to changing public health practices, the commercial industry is expected to remain strong.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Real Estate Trends & Predictions For 2022

Many experts are eyeing the real estate industry to see what will happen in the year ahead. A brief review of previous years might suggest that while predictions can be useful in planning, they are not entirely accurate. For example, at the start of 2020 many would never have guessed the biggest driving factor in the market would be the COVID-19 pandemic. As we head into 2022, the effects of the pandemic continue to drive several changing trends in real estate including an emphasis on e-commerce, upgraded rental properties, and inventory shortages.

Real estate investors should keep an eye on the return to retail spaces. While the conversation around e-commerce has continued to suggest an end to brick-and-mortar stores, this is simply not the case. Many individuals, in light of eased COVID-19 restrictions, still want to attend restaurants, shop, and spend time in commercial retail spaces. With the exception of possible vaccine and mask mandates, many commercial areas are open for business as usual and investors should expect that trend to continue.

Professionals across the industry have been anxiously waiting to see how many companies continue work from home policies in the future, and the answer is still unclear. What we do know is that many top companies still want employees back in the office — promising news for commercial spaces. Note that the decision to work from home vs. return to the office is very divided by industry (for example, Tech seems to be leading the work from home push). Investors interested in office spaces should consider possible tenants and which spaces would be best for these businesses.

A few other trends to consider in the year ahead include the recovery of multifamily rental units and a shortage of housing inventory. Investors may find they are able to keep vacancies low in the year ahead with single-family and multifamily rental units. On a final note, investors should keep an eye out for state and federal plans to improve infrastructure across the country. These changes could greatly increase the accessibility of commercial spaces and increase demand from tenants.

2022 is expected to be an interesting year for real estate market trends. Investors should keep an eye on both residential and commercial trends to stay informed about the year ahead. For those looking for new markets to watch, here are the top 10 markets to pay attention to in the year ahead:

-

Dallas, TX

Real Estate Trends & Predictions For 2021

Commercial real estate was expected to face some interesting challenges throughout 2021. Most notably regarding the future of remote work and office buildings. With a large portion of the workforce remote due to COVID-19, many investors questioned the future of office buildings and long-term commercial leases. These concerns were heightened as big-name tech companies announced employees would be able to work from home permanently. Many expected

office buildings to reopen as the vaccine is distributed across the country and the economy returns to normal.

While office spaces were expected to bounce back, so to speak — 2021 saw a rise in something called “dark stores.” Dark stores refer to retail outlets or distribution centers that have shut down inside operations and instead allow for curbside pickup or shipping. Dark stores were used before the COVID-19 pandemic, but as expected, they increased in size and demand as restrictions were put in place on in-person shopping and dining. Real estate investors hoping to tap into this trend today should look for properties that are easily accessible and in popular market areas.

Warehouses represented another promising commercial property type for 2021. The demand for warehouses increased dramatically as retailers attempted to keep up with the rise in e-commerce. Real estate investors can expect the property value of warehouses and other industrial property types to continue to increase in the years ahead. Owners can not only benefit from property appreciation but an increase in average rent prices for these spaces.

Unfortunately, not all areas of commercial real estate were expected to thrive as the world continues to feel the effects of the pandemic. Investors were warned to be wary of hotels and other areas of hospitality-related real estate. These industries are expected to recover at much slower rates than others, particularly in dense cities. Investors who are eager to find opportunities in hotels should be sure to focus on markets that are recovering more quickly than others.

There are a few real estate markets that are expected to stand out in the year ahead as a result of job growth, cost of living, and population increase. Here are some of the top growing commercial real estate markets from 2021:

-

Tampa Bay, FL

-

Nashville, TN

-

Raleigh-Durham, NC

Real Estate Trends & Predictions For 2020

When 2020 began, many industry experts predicted sustainable but slow growth across the commercial real estate market. Experts predicted the impact of changing demographic trends, as both Baby Boomers and Millennials’ preferences changed regarding housing, office, and other properties.

With the U.S. experiencing its longest expansion in history, many believed the slow and steady growth would continue in 2020. At the start of the year, mortgage rates were at 3.75%, according to Freddie Mac. This was nearly a 1% difference from the monthly average just a year ago. At the end of 2019, this drop in rates was the cause of a surge in refinancing and purchase activity. Among experts, there was a consensus that rates will remain low in 2020, somewhere between 3.7% and 3.9%

Due to high demand, prices for homes were predicted to continue their climb upward. Home prices were estimated to rise by 5.6% by Fall 2020. This is an increase of about 2.1% from last year. With more and more listings coming on the market, there will be much more competition starting in early 2020. On the lower price end, low-interest rates and a shortage of entry-level homes will cause prices to rise even more. The shortage of entry-level homes is due to builders tending to focus more on higher-end, higher-profit homes.

Housing inventory was predicted to remain limited for most of 2020 due to interest rates and record-high homeownership tenures. According to Redfin, homeowners stay in their homes for an average of 13 years or higher, a 5-year increase from 2010. Homeownership tenure in some cities goes as high as 23 years. Essentially, you can’t buy what’s not for sale. Even with historically low rates, potential buyers risk buying in a market with a supply shortage. This trend was predicted to continue through 2020 and may even intensify in the coming years, directly affecting commercial real estate as a result. A bit of relief to this situation may come with the projected increase in construction. According to the Census Bureau report, both building permits and housing starts have increased over the year. Realistically, the pace of building is still behind historical standards, meaning it may take months before the pace can support the higher demand.

According to Realtor.com, Millennials were a significant 46% of all mortgage originations in September 2019. This was no surprise as many Millennials regard homeownership very highly in their life goals, even higher than getting married or having children. The combination of low-interest rates and higher incomes urged more and more Millennials to close deals on homes. A problem they face comes from the Baby Boomer generation. Many of this group choose to stay in place, resulting in more homes being kept off the market. As Millennials get older, many of them will move from urban to suburban areas. Although, they yearn for a community that can imitate the lifestyle of a lively city. This trend is drawing Millennials toward affordable suburban homes on the outside of major cities. As cities like New York and San Francisco become increasingly expensive, younger families populate the small towns outside major urban areas.

These commercial real estate trends give rise to the growth of a number of cities in the coming year. The best commercial real estate markets for overall investment and development in 2020 include:

-

Austin

-

Raleigh/Durham

-

Nashville

-

Charlotte

-

Boston

-

Dallas/Fort Worth

-

Orlando

-

Atlanta

-

Los Angeles

-

Seattle

-

Tampa/St. Petersburg

These cities are the top commercial real estate markets in terms of population growth and net migration. Larger metros, such as Los Angeles and Boston, are projected to have slower population growth but will continue to be highly sought-after real estate markets that will continue to attract capital.

[ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

Real Estate Trends & Predictions For 2019

Released jointly by the Urban Land Institute and PwC, the annual Emerging Trends In Real Estate report highlighted a theme of unpredictability for 2019. Researchers stated that simply “connecting the dots” will no longer work and that this will be a “new era that will demand new thinking.”

The report also posited that 2019 would lend itself to overlapping trends, with the intersectionalities themselves leading to new conditions. For example, researchers postulated whether or not the technology used to improve productivity and efficiency would accelerate the industry’s downsizing. Investors were advised to prepare to be surprised in any way possible, which was great for spurring innovation and creativity within the industry.

The following covers the top commercial real estate trends and predictions for 2019, as well as a review of the trends in preceding years. Federal officials have hinted that they will continue boosting interest rates to moderate inflation and stabilize the economy. The Federal Reserve hiked rates three times in 2018, between 2 and 2.25 percent. According to Curbed, the slowdown of economic growth will impact the real estate sector, especially in emerging markets. As real estate activity slows, investors will have a tougher time identifying new deals.

In 2018, much of the commercial market’s attention was focused on the compression of the retail industry. CBRE Head of Industrial Research, David Egan, predicted that the shift in demand from traditional retail to industrial real estate will continue. As large retailers focused on e-commerce, the demand for warehouse, shipping, and logistics spaces continued. This was especially true as more and more traditional retailers entered the online space. According to Bisnow, however, the retail industry is not dead. Instead, experts believed retailers would focus on delivering omnichannel shopping experiences, while e-commerce retailers would start opening physical store locations. (Amazon Books is an example of the latter.) Experts also warned investors would need to spend more time supporting the efficient use of commercial space. Retailers were predicted to seek out better (not bigger) brick-and-mortar presences.

Another trend highlighted in 2018, expected to continue in 2019, was the growing number of millennials flocking to secondary and suburban markets. According to the U.S. Census Bureau, 2.6 million Americans moved from cities to suburbs in both 2017 and 2018. Experts believed this mass exodus occurred as millennials opted for larger, more affordable housing in suburbs when starting families. Neighborhoods that were walkable, transit-oriented, and have strong school systems attracted the most newcomers. This trend was of interest to commercial investors; with migration patterns leading to a spike in demand for retail development and employment centers. Multifamily developments experienced “amenity creep,” or a need to provide increased, high-end amenities to attract sophisticated renters and buyers.

Technology was also expected to play a big role in 2019. According to Curbed, industry-specific technology is changing the way real estate professionals do business. For example, there was been a boom in building and construction technology and a push for better, more transparent analytics reporting. Experts were also excited to see how machine learning and other emerging technologies could improve building management, organization, and design. The Urban Land Institute reported increased use of artificial intelligence in assets such as co-working spaces and smart buildings. Uses included building efficiency, safety, and security, as well as property access.

Amidst all these demographic and technology shifts, the Emerging Trends In Real Estate survey reported that construction costs topped the list of concerns for investors and developers. A decline in immigrant construction labor, superstorms leading to rebuilding efforts, and international trade wars were factors squeezing construction costs across the nation.

Finally, the commercial investing community gained a renewed focus on sustainability due to serious reports on climate change. Many investors turned to impact investing, making green practices a core part of their businesses. Keep reading to get an overview of the top commercial real estate trends from 2018 to better understand what factors contributed to these trends.

6 Trends Affecting The Commercial Real Estate Market

If you’re interested in getting your start in commercial investing, then you’ll definitely want to familiarize yourself with the trends and factors that influence commercial real estate market trends. Take some guesses on what kind of factors might attract new businesses and help certain markets boom. Did you guess any of the following trends correctly?

Commercial growth: Directly impacting job growth, the movement of major companies and sector-based growth can all lead to demand for commercial spaces and housing.

-

Development: The urban development of city centers, business districts and public-private projects each affect the attractiveness of a market for commercial real estate tenants.

-

Cost of business: The cost of conducting business will influence how companies move in and out of certain markets. Cities with relatively lower costs of conducting business are more likely to attract new businesses and employment.

-

Infrastructure: Public infrastructure, including public transit, communication, electric and transportation systems all influence the ease of doing business in a market. Cities with continued infrastructure improvements are more likely to attract and retain residents, businesses and tourists.

-

Housing: Local real estate prices, rental affordability, and housing options are all factors that contribute to the migration patterns of workers. For example, a major company may be influenced by their decision of where to move their new headquarters, based on the overall cost of living for their employees.

-

Quality of life: Urban, walkable cities with plenty of public transit, parks, good schools, and entertainment all contribute to the general quality of life for residents. Great quality of life is important considerations for businesses and their employees.

-

Tourism: The tourism industry presents many opportunities for commercial real estate to boom, such as hotels or airports.

How To Determine The Best Places To Buy Commercial Real Estate

Curious about which commercial real estate markets are best for getting started? It’s important to keep a few priority items in mind. Although there will always be variances, commercial markets that embody the following five criteria are known to offer the best returns for investors:

-

Low Unemployment Rates: Cities that have a low or decreasing unemployment rate indicate a robust job market, with a probable demand for office and retail spaces.

-

Low Purchase Prices: This might sound like a no-brainer, but it is important to find a property that is priced either below or at market value. If you want to profit off your renters, consider finding a slightly distressed property that is being sold for a deal. There is also the option to buy a commercial foreclosure property.

-

High Asking Rents: Be sure to do your due diligence before jumping into commercial real estate and research comparable markets to see what average asking rent prices are. If the asking rent rate is high, and your purchase price is low, you should make a substantial profit.

-

High Tenant Demand: Search for up-and-coming markets that are creating new jobs and developing new residential complexes because there will be an increased demand for space.

-

Low Vacancy Rates: If you have high tenant demand coupled with low vacancy rates, you will be able to charge a higher rent price, therefore increasing your profits.

-

Favorable Conditions For Business: Pay attention to local and regional economic policy. Are new plans attracting businesses to the area? Review the tax rates for business owners and economic growth as indicators.

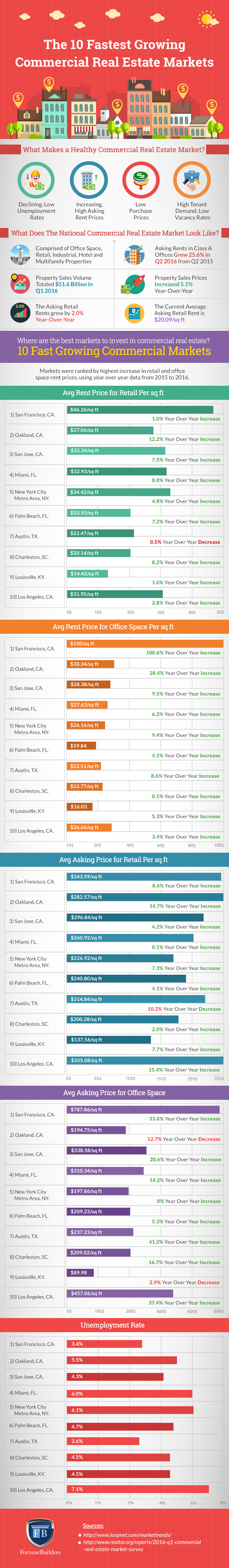

Top 10 Fastest Growing Commercial Real Estate Markets

There are four different types of commercial real estate spaces investors can consider: retail, office, industrial, and multifamily complexes. If you’re looking to invest on a budget, experts recommend starting with either industrial spaces or multifamily complexes, as those options tend to have lower price points than retail and office spaces.

If you think you’re ready to make the jump into commercial real estate, consider these rapidly developing markets, which are arguably the best places to buy commercial real estate right now:

Summary

Although predicting the future of the commercial real estate market might seem like a job for economists and top-rate experts, the truth is that any investor can make their own educated guesses. As shown in this discussion, market trends are extremely interconnected from year to year. All you have to do is study up on market outcomes from previous years, as well as have an understanding of the economic drivers that impact the current commercial market. Investors who take the initiative to perform their own research and make educated predictions will be the ones who beat their competition and find the answer to: what are the best real estate markets for commercial investments?

Ready to start taking advantage of the current opportunities in the real estate market?

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!